- accueil

- >

- Our skills

- >

- Fostering shareholding

Employee, entrepreneurial or family shareholders generate a significant number of tax issues throughout their ownership.

An international dimension and a particular type of holding (Heritage holding, Trust, foundations, etc.) will increase the number of impacts to be analysed.

Structuring of private and professional assets

The choice of a structure adapted to the objectives pursued, the tax and social regime of the shareholders and the manager are essential. The transmission of this heritage is also an important subject.

Employee shareholding

The various forms of employee share ownership, the many changes to the various plans in France over time make monitoring of his rights essential.

An international activity or mobility will make the subject even more complex and the assistance of an international team will be essential.

Corporate Executive

The status of the company director, his or her remuneration method, and all taxes related to his or her income, shareholding and wealth must be considered in a comprehensive manner.

Management package

Managers’ profit-sharing schemes take many forms, the tax and social treatment of which is sometimes unclear. Controlling the stakes and the applicable tax and social regime are essential to preserve one’s wealth.

An international operation will add an additional level of complexity that needs to be addressed technically and declaratively.

International Structures

The creation, monitoring and liquidation of international structures must be examined both in the country where the structure is located and in the countries in which it operates, as well as in the countries of residence of the shareholders and beneficiaries of distributions.

Content under construction

Content under construction

Content under construction

Content under construction

Content under construction

Content under construction

Content under construction

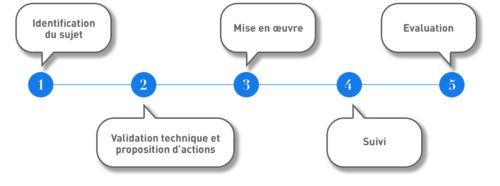

Our approach

According to the identified needs, we propose you a contact with an expert who will be able to validate the subject and propose an approach.